Octobat for SaaS

Tax compliance as a service for recurring billing models - made easy

Tax rules for digital goods and software services are rapidly changing nowadays, making compliance a hard to manage matter for manual methods. Our automated tax calculation engine and invoicing help you stay compliant with international and national rules - reduce the risk and grow your business.

Tax calculation

Bring real-time VAT/GST/Sales Tax calculation whether you’re selling Software as a Services, digital goods, ebooks, streaming media or any digital services. Octobat is compatible with recurring payment methods.

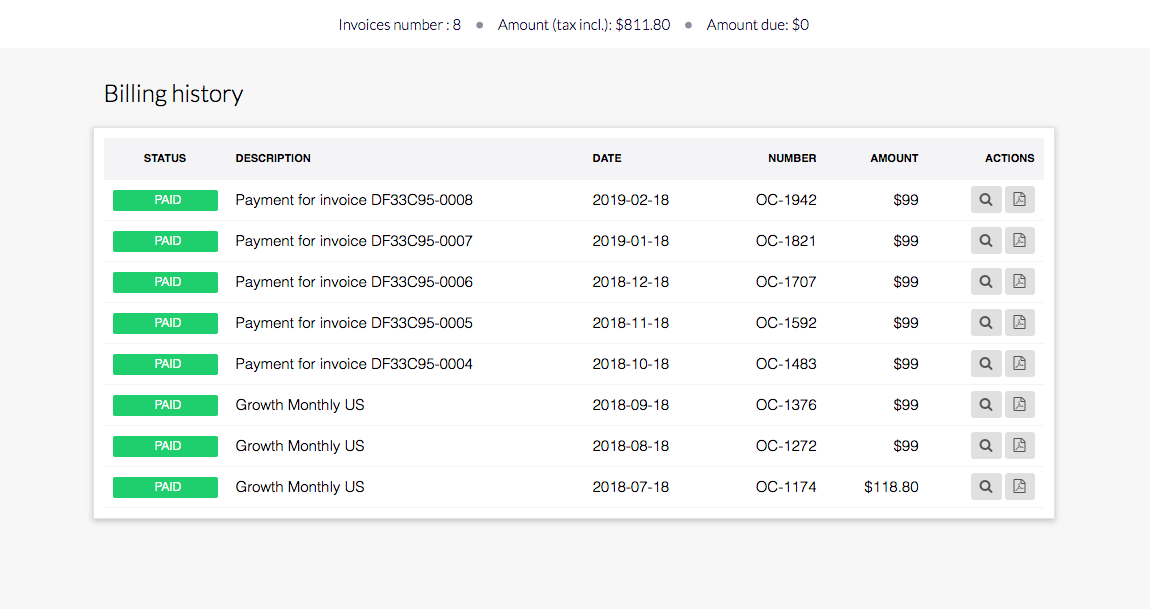

Maintain long lasting relation with your customers

Don't waste any more time dealing with customer requests for their invoices and credit notes - Add a billing history section to your website/app so they can download their past invoices and credit notes whenever they want. Help them update their billing information and remain compliant.

Stay ahead of tax requirements

Octobat tax experts constantly monitor and detect international and national tax reforms so the system always applies the latest tax rule and rate - be focus in your growth, not taxes.

Direct integrations

Use our direct integrations to add accurate tax calculation on top of your payment provider stack. Use our RESTful API to connect with any other.

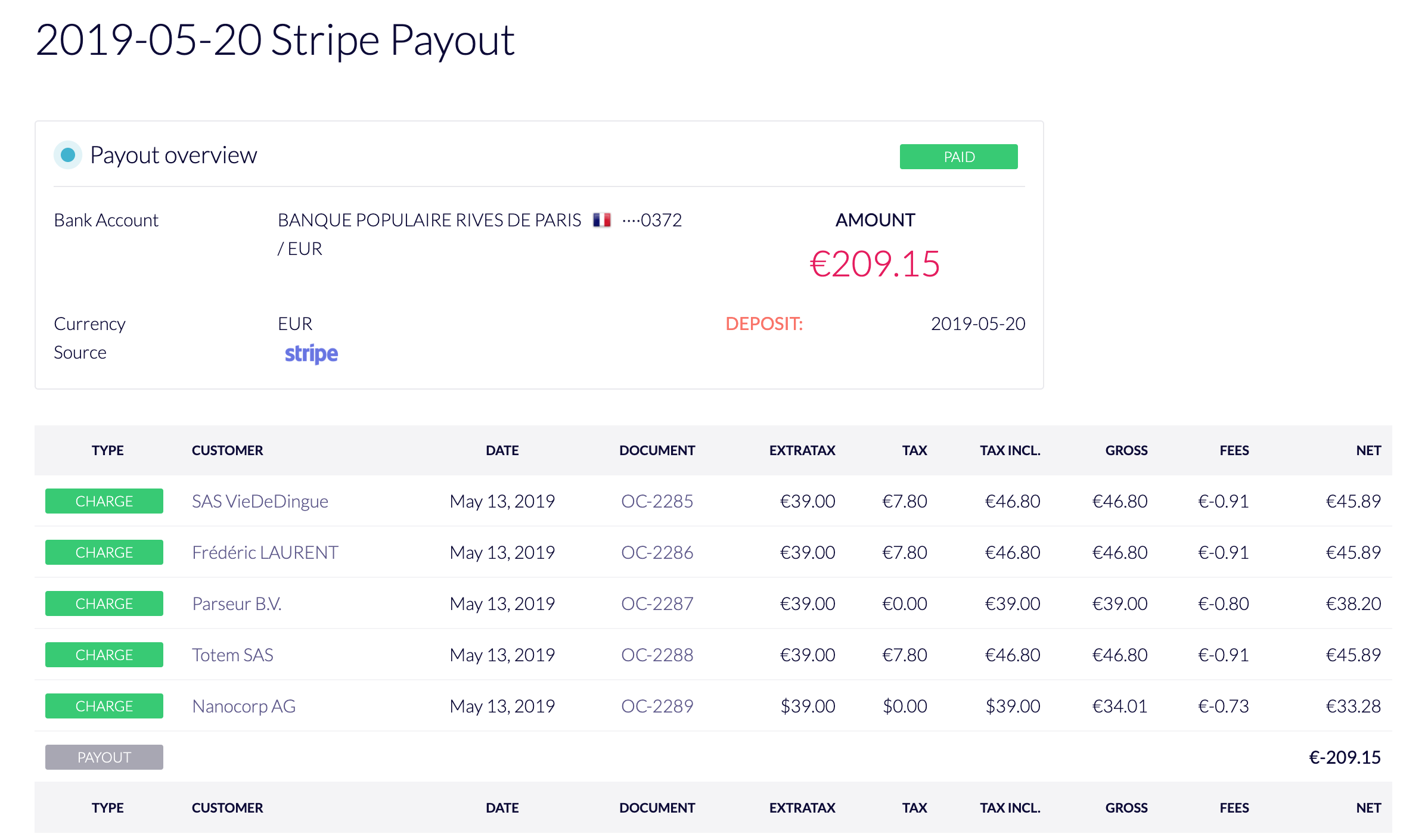

Accounting made for recurring model

Get your built-in revenue statements and bank reconciliation by simply clicks - forget about spreadsheets matching and save hours of manual work. Get the best for your accountant and focus in your sales.